This blog was written by Teddy Woodhouse, Research Analyst & Advocate at the Web Foundation.

The conclusions from this year’s Affordability Report are clear: the policy decisions made in the past two years have had a demonstrable impact on the affordability of data for the people in those countries. Here’s a quick summary of how the 37 middle-income countries surveyed for our report performed, and what their policy performance has meant for the affordability of mobile broadband.

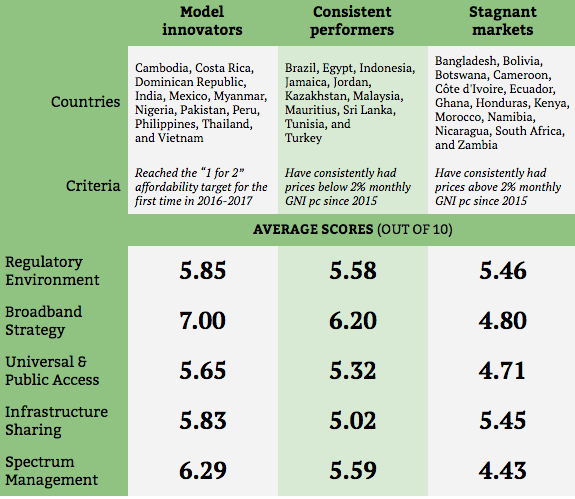

Among the middle-income countries we have studied, countries fit into three groups:

- Model innovators: These are the 12 middle-income countries that attained the “1 for 2” affordability target (i.e., saw the price of 1GB of mobile broadband drop to less than 2% of monthly average income).

- Consistent performers: These 11 countries had prices below the affordability target in 2015 and continued to do so in 2017.

- Stagnant markets: These 14 middle-income countries had prices above 2% of monthly average income in 2015 and continued to have prices above the affordability target in 2017.

These groupings are based on the affordability of data in each country and are measured on their policy performance in the latest policy survey conducted by A4AI as part of the 2018 Affordability Report. (More information on the survey methodology can be found here.) Scores reflect the average scores within each of the five policy clusters identified by A4AI as connected to driving down the cost of mobile broadband.

By examining the performance across these three country groups we can see the impact that policy has had on broadband prices. Countries that have had the greatest success in driving down prices and reaching the affordability target for the first time score more highly on measures of policy than those countries that have consistently had low mobile broadband prices. At the other end of the spectrum, countries that have failed to invest time into effective broadband policy have not seen the reward of affordable data.

Progress toward affordable internet has been particularly notable across three A4AI member countries: Dominican Republic, Myanmar, and Nigeria. Of the countries that now meet the ‘1 for 2’ affordability target, these three countries had the least affordable data in 2015. This progress validates a continued commitment to the importance of a multi-stakeholder approach to developing broadband policy in low- and middle-income countries.

Countries in the model innovators group also reaffirm the importance of prioritising high-level broadband strategy, investment in universal and public access, and transparent spectrum management for reducing the cost to connect. Countries where mobile broadband costs have dropped the most saw high scores across these policy areas; similarly, these three topic areas are where, among middle-income countries, the widest policy gaps are found between countries with affordable data and those without it.

Policy decisions can motivate the market conditions for more affordable data. In turn, the more affordable mobile broadband is, the more people can afford to come online. As we reach the moment where over 50% of the world’s population will connect to the internet, there is still plenty of policy change left to undertake.