Acknowledgements

This report was written by and prepared under the direction of Teddy Woodhouse, with contributions from Glenn Maail, Ana María Rodríguez, and Calum Cameron. Additional comments and suggestions were provided by Nathalia Foditsch, Carlos Iglesias, Sonia Jorge, Eleanor Sarpong, and Dhanaraj Thakur.

The authors also wish to thank the interviewees from around the world and from various backgrounds who contributed their time and insights to help inform the analysis and recommendations of this report.

Any errors remain that of the authors alone.

Published 6 August 2020.

Suggested citation: Alliance for Affordable Internet (2020). From luxury to lifeline: Reducing the cost of mobile devices to reach universal internet access. Web Foundation.

Executive Summary

Mobile devices, historically seen as consumer luxuries, are essential doorways to internet access. The vast majority of the next billion people who come online will do so using a mobile phone. These handsets are essential for making progress towards universal internet access and driving an inclusive digital society.

The biggest barrier to internet access today is cost. The internet is still not affordable for many around the world. This applies to data, which is still too expensive for most people in low-income countries. And equally, for those who can not afford to buy an internet-connected device, the online world remains out of reach. Bringing down the cost of mobile devices is essential to get more people online.

Covering 70 low- and middle-income countries, this report provides the first openly available global survey of mobile handset costs — looking not only at the retail price of a device, but their affordability: price in relation to income.

This snapshot gives a picture of device affordability in 70 countries with a combined population of over five billion people. Policy action in these countries — many of which have low levels of internet penetration — can help make the internet more accessible for billions more people.

A lifeline, not a luxury

The Covid-19 crisis has underlined that the internet — and the devices that allow people to access it — are not luxuries. These devices are lifelines and governments should be setting policy accordingly to ensure as many people as possible can buy them.

Now being used for everything from remote learning and working to contact tracing and telehealth, internet connectivity has never been more important. Access is critical not only for individuals’ wellbeing, but for the health of a country’s economy. With the economic disruption of Covid-19, digital growth will be even more important for national economic performance.

Yet, almost half of the world’s population remains offline. And those without internet access are disproportionately women, and people on low incomes and in rural areas — groups already likely to be most affected by the impacts of the pandemic. To avoid a world where digital inequalities drive further inequalities in health, wealth, and education, we need action to address barriers to connectivity.

Measuring the cost of smartphones across 70 countries

Our survey focuses on smartphones because these are the devices most people use to connect to the internet and they provide the level of functionality people need to use the full power of the internet, in line with A4AI’s meaningful connectivity standard.

In each of the countries included, we collected the cheapest available online price for a smartphone from a major mobile network operator. We also benchmarked prices for feature phones which, while not as powerful as smartphones, can provide some level of internet connectivity at a lower cost than smartphones.

Device affordability is a huge barrier to internet access for billions of people

While the price of mobile devices has fallen steadily over recent years, nearly 2.5 billion people live in countries where the cost of the cheapest available smartphone is a quarter or more of the average monthly income. This is equal to the share of monthly income the average European household spends on housing and utilities.

In some countries, devices were less affordable still. In Sierra Leone, the average person needs to save six months’ salary to buy the cheapest available smartphone. In India, where almost 18% of the global population now lives, the price of the cheapest smartphone from leading operator Jio was 206% of average monthly income. This is striking in a country that has some of the lowest-priced internet data in the world.

There is a stark divide between countries for handsets affordability. Botswana topped the survey for most-affordable devices, with a low-cost smartphone priced at just 4% of average monthly income, with Jamaica (5%), Mexico (5.7%) and Costa Rica (6%) following closely behind. While these countries are outliers on either end of the price spectrum, we also see a wide disparity among regions. In Africa, devices were least affordable at 62.8% of average monthly income compared with 11.7% in the Americas and 16.2% in Asia Pacific (excluding India). With India included, the Asia Pacific figure jumps to 87.4% owing to the country’s role as an outlier with a very large population and high costs.

Recommendations to bring down device costs

Device affordability is driven by a range of factors, such as production costs and market competition, consumer preferences, tax policy and the average income in a country. There are things that governments and multilateral bodies can and must do to shape markets and help bring down costs for consumers:

1. Reduce taxes on low-cost devices

Policymakers can make quick progress on device affordability by reducing taxes that apply to low-cost devices. This directly brings down costs for consumers and, if applied to low-cost devices only, can encourage manufacturers and retailers to offer lower-priced products to qualify for the tax exemption, decreasing prices across handset markets.

To be effective, governments must design and monitor policies carefully to make sure that changes in the tax regime translate into lower prices for consumers. While targeted tax reductions mean lower tax revenue short-term, the increase in digital activity as more people use the internet is likely to drive higher long-term economic growth.

2. Use Universal Service & Access Funds (USAFs) to subsidise devices

The poorest households face the largest affordability barrier. USAFs exist to make telecommunications services available to the widest number of people possible, particularly marginalised and underserved communities. This should include addressing the device affordability barrier which few USAFs currently cover. These funds can be used to make devices more affordable, including with subsidy programs for those least able to buy devices.

Countries like Malaysia, through its smart device subsidy, and Costa Rica, through the Hogares Conectados program, offer compelling examples of how USAFs can be used to make devices more affordable for the most vulnerable.

3. Support projects to help people spread the cost of devices

For many users, a major barrier to buying a device is the large upfront cost. While some countries have well-established credit systems letting consumers spread the cost of a handset over monthly payments, for many consumers such facilities are not available, particularly in lower-income countries — the places where people are least likely to have large amounts of cash on hand for such purchases.

One important way to make devices more affordable for these users is to develop and scale innovative financing models to reduce the upfront capital people need. Several examples already exist, many of them supported at a pilot-level by funders like development agencies.

The next step is to move this from experiments to scale successful projects. The public and private sectors and civil society should work together in partnership to support projects like this to make more financing options available for consumers.

Device price is a barrier to internet access

While the Covid-19 pandemic has underlined the critical importance of internet access in today’s world, almost half the world’s people are still not connected to the internet. The biggest barrier to access — particularly in low- and middle-income countries — is the high cost of connectivity. Though internet-connected devices and data tariffs are becoming cheaper, the cost is still too high for billions. For several years the Alliance for Affordable Internet (A4AI), an initiative of the Web Foundation, has published data on mobile broadband prices and has set a standard for data affordability. Now, this report looks at another aspect of the affordability challenge, focusing on the cost of the devices people need to connect to the internet, specifically mobile devices which offer the most promising route to access for the billions not yet connected.

Mobile devices can no longer be considered a luxury. They are a doorway to so many critical services — from educational resources and online banking to telehealth and government services. People understand the value of these devices and want them in their lives. Mobile phones and laptops repeatedly show up as many families’ most loved item in the Gapminder Dollar Street data. The same data set shows how income inequality impacts the devices people can buy and how that impacts their experience of the internet. Until the cost of both data and devices are within everyone’s reach, we will not reach universal internet access, and billions will remain offline and unable to reap the many benefits of digital technology.

This report:

- Measures how affordable devices are for people in low- and middle-income countries

- Explores the factors that contribute to the cost of devices

- Provides recommendations to make devices more available and affordable so that more people can access and use the internet

Our research for this report draws from the device categories used by many others, including the After Access surveys, and focuses on three groups: basic phones, which have no internet functionality; feature phones, which have some internet functions; and smartphones. We also use the term ‘internet-capable devices’ to refer to feature phones and smartphones in common.

Table 1. Types of mobile devices

| Basic phone | A mobile communication device that can make telephone calls and sometimes also send and receive SMS messages. These commonly have a twelve-key touchpad. |

| Feature phone | A mobile communication device that has the functions of a basic phone and some internet capabilities, even if limited to pre-selected applications or to basic HTML pages. These devices commonly have a twelve-key touchpad or a tactile keyboard. |

| Smartphone | A mobile communication device distinguished by its operating system, its ability to download third-party applications, and its touchscreen of at least three inches. |

Table 2. Most and least affordable smartphone offers in study countries

| LEAST AFFORDABLE |

|---|

| 1 Sierra Leone 636% ($265) |

| 2 Burundi 221% ($52) |

| 3 India 206% ($346) |

| 4 Niger 189% ($60) |

| 5 Central African Republic 122% ($49) |

| MOST AFFORDABLE |

|---|

| 1 Botswana. 4.03% ($26) |

| 2 Jamaica 4.91% ($20) |

| 3 Mexico 5.66% ($43) |

| 4 Costa Rica 6.09% ($58) |

| 5 China. 7.02% ($55) |

Affordability is device price as % of monthly GNI per capita. Prices are in USD. March 2020. | Source: A4AI, 2020

Figure 1. Heat map of device affordability in 70 countries included in study

This map tracks the price of smartphones across 70 low- and middle-income countries around the globe, measured as % of monthly average income.

State of Device Affordability

We assessed the affordability of internet-capable devices by collecting online price quotes for smartphones and feature phones from a major mobile network operator across 70 low- and middle-income countries.1 This measure — device affordability — positions device price as a fraction of the average income and contextualises retail market data with income disparities.

Our primary focus is on the cost of the cheapest available smartphone, as the ideal device for mobile internet use, in line with A4AI’s meaningful connectivity standard. Many of the upper middle-income countries we measure have higher-end devices — such as various models of Samsung Galaxy range — as the most affordable smartphone, indicating an appetite for more expensive devices in those countries. In other countries, especially in least developed countries, the best price point for consumers is through simpler and more limited feature phones.

The meaningful connectivity standard

A4AI’s standard for meaningful connectivity sets minimum thresholds across four dimensions of access that matters most to users: regular internet use, speed, data, and device.

This standard includes individual access to a smartphone. Making devices more affordable can increase smartphone penetration – and therefore, meaningful connectivity within a country. And so we focus primarily on the affordability of smartphones.

Because there are different product offerings across different markets, there is limited potential for like-for-like comparison between countries. However, consistently across the countries we measured, the prices of smartphones are too high for most low-income users.

Costs for consumers vary substantially across different countries, and the regional averages in Table 2 do not show the full extent of the stark differences that exist between countries of the same region, both in the unit cost of devices, but also device affordability. Within our pricing comparisons, the cheapest route to a smartphone ranges from around $18 in Lesotho and Mozambique to $346 in India. A comparison of device prices along country income groups gives us an alternative view of device affordability.

Figure 2. Average smartphone price and affordability, by region2

| Region | Price | Affordability |

|---|---|---|

| Africa | $62 | 62.8% |

| Americas | $67 | 11.7% |

| Asia–Pacific | $168 | 87.4% |

| Asia–Pacific (excl. India) | $60 | 16.2% |

Price is measured in US$, and affordability is the device price as a % of monthly GNI per capita | Source: A4AI, 2020

Several factors influence the retail price that a user can expect to pay for a new smartphone — from the component costs to taxation and market preferences. In higher-income countries, we found that operators generally offered a wider range of devices, meaning that lower-income users in higher-income countries generally had more choice than those in lower-income countries.

Table 4. Median smartphone offers & reference device in study countries, by income group

| Income Group | Device Cost | Affordability |

|---|---|---|

| Low income | $42.00 | 81.24% |

| Lower-middle income | $58.10 | 43.04% |

| Upper-middle income | $55.70 | 10.1% |

This table is limited to the 70 countries in our device pricing study. | Source: A4AI, 2020

It’s not about the price – it’s about affordability.

Affordability is about income as well as the price of devices. In Mozambique, a smartphone costs US$18. In Argentina, it costs $122. However, because the average monthly income in Argentina is 30 times higher than in Mozambique (US$1,031 to $37), phones are more affordable in Argentina even though they are more expensive. So, when determining affordability, we do not consider the price of a device without looking at incomes. This report, therefore, measures the price of devices, expressed as a share of average monthly income.

Figure 2. Comparison of smartphone prices and smartphone affordability, March 2020.4

Affordability is about income as well as the price of devices. In Mozambique, a smartphone costs US$18. In Argentina, it costs $122. However, because the average monthly income in Argentina is 30 times higher than in Mozambique (US$1,031 to $37), phones are more affordable in Argentina even though they are more expensive. So, when determining affordability, we do not consider the price of a device without looking at incomes. This report, therefore, measures the price of devices, expressed as a share of average monthly income.

Poverty Affects Market Power

Device brands like Samsung and Apple — whose devices were highly-desired in our focus groups5 — are two of the largest producers of mobile devices. However, a large number of the devices they provide are not affordable for billions of people. In addition to collecting prices for the most affordable devices, we gathered data on the cheapest available iPhone on market. These ranged from $135 for an SE 32GB device in Mexico to $1,290 for an XR 64GB device in Cameroon. This additional dataset reflects the diversity of device options available and underlines that the device affordability gap creates a digital capabilities gap. For people in low- and middle-income countries, premium devices are simply out of reach for the vast majority of people. We found that iPhones cost less than the average monthly income in just 13 of the 49 countries where we could get a reliable price quote — all in the upper middle-income group. In 27 countries, the cheapest available iPhone was at least twice the average monthly income, rising to over two years’ income in countries like Niger and Madagascar. As a comparison, the cheapest smartphone in Madagascar was priced at 87% of average monthly income and the cheapest feature phone at just 28%.

High device costs can particularly impact women. Men are 25% more likely to own a smartphone than women6 and, with more limited purchasing power, women are less likely to have an up-to-date device with rich functionality. Additionally, cultural norms can discourage women and girls using mobile devices for a number of reasons, particularly higher-end devices which can carry additional stigma for a woman because they enable more activities, including leisure and wider social communication. These factors come together to push more women into informal device sharing and gifting, rather than purchasing devices themselves — such themes and experiences were commonly shared among women participants in our focus group discussions.

The Role of Feature Phones

At the other end of the affordability spectrum for devices, feature phones and other entry-level devices can provide an entry point to digital technologies to people who cannot afford smartphones. They lower the price threshold for a first-time user who may have yet to build extensive digital skills or experiences that would justify the expense of a more high-end device, while providing some of the features and benefits of a smartphone.

The regional differences of feature phone prices are smaller than for smartphones; however, when these prices are expressed as percentages of average monthly income, the disparities of affordability are far greater (see figure below).

Figure 3. Comparing median affordability of smartphones and feature phones, by income group

Case Study: Device Prices in India

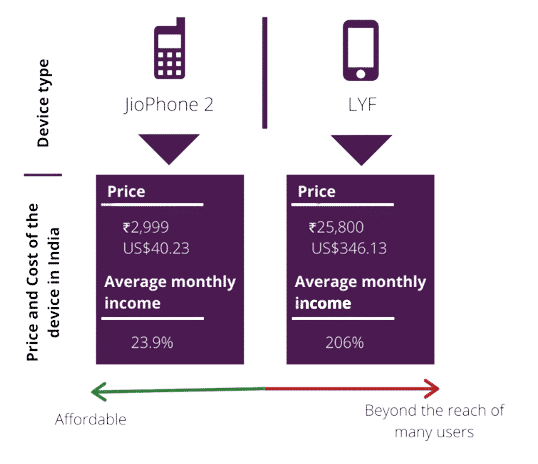

In India, the cheapest available smartphone from leading operator Jio is the LYF device, retailing at ₹25,800 (US$346.13) — more than twice the average monthly income. Far beyond the reach of most users, the cost of the device makes India an expensive outlier in our study. The JioPhone 2, at ₹2,999 (US$40.23, 23.9% average monthly income), is the feature phone used as the country’s cheapest internet-capable device benchmark. The price disparity between the two phones demonstrates some of the many of the dynamics that affect device prices.

Our methodology is based on the devices on offer on the websites of mobile network operators. This comes with limitations but reflects the important role that operators play in creating trust in the device market: people are more likely to trust the quality of a device being sold by an operator with a recognisable brand name. This holds a dilemma for many operators in emerging markets: device retail is not an operator’s primary business, yet the availability of devices in the market determines how many people can become users and what those users do online.

An operator’s participation in the device market supports its primary business by creating and retaining new customers. This is a clear part of the strategy around many ‘original design manufacturer’ or ODM offerings. Learn more about ODMs.

The JioPhone, an example of such a device, carries the operator’s brand and is much more affordable for customers, especially compared to the next-cheapest device offered by Jio, the LYF smartphone (although, LYF is also a subsidiary of Jio). Indeed, beyond the self-brand JioPhone, Jio’s device offerings are concentrated on high-end devices that carry a larger retail markup and speak to an affluent market segment.

The price point here is also influenced by the tax environment, as many mobile devices, such as the LYF smartphone, are manufactured abroad, imported, and subject to a targeted 10% tax that gets passed onto customers in the retail price of a device. Learn more about how tax affects a device’s cost.

This example in India demonstrates many interrelating dynamics in device pricing and the affordability challenge. In the production line, taxation issues have an impact on a number of devices, particularly those in the higher-end smartphone market. At the retail stage, the operator’s structuring of the market heavily influences perceptions of affordability. In this instance, where Jio’s online device marketplace offers only the JioPhone or a range of expensive smartphones, the choice for a cost-conscious consumer becomes clear. Because of the role of operators in setting expectations for users in the marketplace, the wide gulf in price that Jio offers between a smartphone and a feature phone has an impact on the market as a whole.

Device Costs & Digital Development

The world is facing extreme economic headwinds as hundreds of millions of lives and livelihoods are threatened by the Covid-19 pandemic and widespread lockdowns. The benefits of digitalisation have been well documented over the years. Digitalisation is critical for countries’ recovery, both because of the economic gains offered by digital development and because internet access has proved a key tool for continuing to live and work while being required to practice physical distancing. There is also evidence suggesting that higher levels of digitalisation can mitigate the pandemic’s consequences.

And yet, the twin challenges of production disruptions for device makers and a rise in global poverty threatens to slow the growth of smartphone ownership and therefore internet access.

— Digital technology will be critical to help countries move past Covid-19. But without action, the cost of devices will be a drag on the post-pandemic recovery. —

Many countries have seen a pause in production: consultancy firm IDC anticipates the largest year-on-year drop in smartphone shipments in the first quarter of 2020. This supply-side shock comes paired with reports of deep economic impact across the globe, including from UNU-WIDER that predicts nearly a half a billion people could be pushed back into poverty as part of the lockdowns in response to the Covid-19 pandemic. As poverty increases, demand for devices is likely to fall, with fewer people having the disposable income to purchase a new handset.

Together, these shocks point to a crisis for digital development as devices move even further out of reach for the most vulnerable. This further limits countries’ economic and social resilience in the face of an unprecedented public health crisis. Without policies to make smartphones more affordable, digital development could stall, creating further drag on countries’ economic performance.

1To understand mobile device costs, we looked for the cheapest available feature phone, smartphone, and iPhone in seventy low- and middle-income countries and measured that price as a proportion of the average income in that country. Full data set available here.

2This data is weighted by population, to reflect the influential experiences of larger countries and the affordability of devices in those markets.

3Because of India’s outlier position and its confounding effect to the regional average, we have drawn the rest of the Asia–Pacific region out separately for comparison. In India, the cheapest smartphone retailed for $346, at 206% the average monthly income.

4This table uses normalised values on a 0–100 scale to better understand the relationship, and two outliers (India and Sierra Leone) have been excluded from the visualisation here.

5As part of this research, we conducted focus groups in five West African countries: Côte d’Ivoire, Ghana, Benin, Nigeria, and Cameroon. Details on these focus groups and the methodology used are available in Annex 2.

6While this statistic relies on analysis from the GSMA and reports the gender gap as 20%, we use a women-centred analysis to calculate and report gender gap data. This method reports the same data as 25%.

Device costs are more than the sum of its parts

The price a consumer pays for a device is the accumulation of multiple small costs and transactions — from manufacturer to distributor, distributor to retailer, and so on. Competition has decreased costs over time and on the manufacturing side particularly, competition has driven component costs, such as device hardware, software, and assembly, close to their feasible minimums. The global scale of this market helps make devices more affordable. However, there’s still more to be done. For instance, governments can influence the affordability of devices through policies such as how devices are taxed. Indeed, tax reform offers the most direct route on the supply-side that policymakers can take to make devices more affordable.

Components & Manufacturing Costs

The manufacturing costs of devices continue to reach new lows. Some estimates suggest hardware components make up approximately 35-45% of the retail price, with the biggest costs coming from the display, core processor, memory and camera. Technological advances over the past few years have made it possible to reduce assembly costs to historic lows and the global integration of smartphone manufacturing has delivered further price reductions.

The diversity of devices and their prices to a large extent reflects the different costs of their components. Devices from brands like Apple and Samsung were frequently mentioned in our focus groups as some of the most expensive but also the most desired devices on the market. Other manufacturers produce cheaper devices, with less functionality at more affordable prices.

As more people from low- and middle-income countries come online, they present a growing market opportunity for device manufacturers and retailers. But today, with limited market power, low-income users are not yet driving the market, which is still largely oriented to more wealthy users.

Achieving Economies of Scale

Many small countries — particularly island countries and those without a major multinational mobile network operator — have additional challenges to providing affordable devices. One of the biggest factors is scale, with manufacturers and providers less able to benefit from the efficiencies of marketing to big, continental states. And, in these contexts, distribution chains are often more disparate, adding extra costs to reach consumers.

To make devices more affordable, manufacturers need to operate at economies of scale. The cost per unit can be reduced by producing devices on a larger scale, where the per-unit cost falls as more devices are made. A counter-example, showing the potential to reach economies of scale, is seen through the collaboration between manufacturers and multinational network operators using their original design manufacturer (ODM) offering. Our pricing data shows that such a strategy was able to provide significantly lower device prices for consumers. In 22 countries, we found an ODM was the most affordable smartphone a consumer could buy.

What’s an Original Design Manufacturer (ODM)?

ODM refers to when a company will mass-produce a mobile phone model, sell them onto a retailer, and that retailer then sells the device under their brand name. Such devices were prolific in our data set. The Halona device — manufactured by MobiWire and sold by multinational network operator Orange — was the reference device in four different West African countries. Vodacom’s Smart Kicka 3 — as available in Lesotho and Mozambique — is the cheapest device in our data set in terms of device price.

Table 5. Average price of ODM and non-ODM devices in studied LMICs, March 2020

| Device Group | Average Price (Mean) | Average Affordability |

|---|---|---|

| ODM Devices | $39 | 45.6% |

| Non-ODM Devices | $81 | 52.9% |

Such devices play a key part in the device market: they offer a more affordable price point for first-time consumers who may not have the savvy to find the greatest bargain or who want the additional trust of purchasing from a recognised retailer, such as the network operator. These device markets help onboard new users and are most common in countries with the lowest rates of internet use.

Network operators have a business interest in providing affordable devices so that more people can become customers for their primary business of mobile networking. By leveraging their buying power as a private business, operators can negotiate a lower manufacturing cost for a streamlined production of the same device and distribute it across multiple countries.

Importation & Taxation

Taxes can have a large impact on device costs, and in some contexts, are areas governments looking to make devices more affordable make quick wins.

Table 6. Types of common taxes applied to mobile devices

| Value-added tax (VAT) | Consumption taxes, like a VAT, are a common form of taxation applied to consumer goods, levied proportionally to the value of the product being sold. |

| Import and customs duty | Import and customs duties, when used, typically apply to devices or device components when they are manufactured in one country and imported into another. |

| Excise tax | An excise tax works much like a supplementary consumption tax but is directed at suppliers and applies to some specific — often luxury — goods, such as tobacco, alcohol, or petrol. |

| Sector-specific tax | A sector-specific tax applies to limited industries or economic sectors to make an additional tax contribution, particularly when that sector is seen as especially profitable. |

Value-added taxes (VAT) and sales taxes generally make up for a significant percentage of a device’s retail cost. OECD data shows, as of November 2018, 168 of the 193 countries with full UN membership levy a VAT on purchases for consumption. Lowering the VAT on low-cost devices can immediately make devices more affordable for low-income users and help shape the market towards lower-priced devices by encouraging retailers and manufacturers to meet VAT thresholds.

The impact of device taxes in India:

The LYF smartphone included in the survey as the cheapest new smartphone in the Indian market faces a specific 10% importation duty, adding roughly $17 per device for customers.

Countries use importation duties, excise taxes, or other sector-specific taxes to skim a revenue off the top of this sector. These taxes can range from 2% to 35% of additional costs on devices, justified by the idea that the ICT sector is a luxury. Such taxes have been the target of previous successful policy campaigns to reduce taxation on mobile devices. The Covid-19 pandemic shows that internet access is not a luxury but a lifeline and a basic right. Internet-enabling hardware must not all be treated as luxury consumer goods.

— Reducing taxes on devices make them more affordable. —

Users at the margins — those with lower-incomes or living in more remote countries or areas — have more limited access to internet-capable devices. Fiscal policies like ICT taxes put further costs on this group, reinforcing the digital divide with a device divide.

Taxing devices offers short term revenue gains but causes long-term delays to reaching greater levels of connectivity and digital activity. Eliminating these taxes might cause a short-term dip in tax revenue, but with the potential for greater productivity and digital activity in the medium- to long-term. The Kenyan government saw this when it eliminated VAT on mobile handsets, resulting in sales increasing by more than 200% in the following years. This, in turn, helped spark greater market competition in mobile broadband with cheaper tariffs for Kenyans and more digital activity across the country.

Policy Recommendations

There is an almost universal interest in making the internet more accessible. The value of this access has been clearly demonstrated through the global response to the Covid-19 pandemic where reliable and meaningful connectivity, including a functional device, has been critical to people’s lives.

Stakeholders must work together to ensure everyone — particularly low-income households — can afford regular access to the internet that could change their lives for the better. This starts with bringing down the cost of devices and making sure people have more access to financial capital.

Governments, companies, development agencies, multilateral institutions, and civil society organisations all have a role to play in this effort.

Three policy actions are key:

- Reduce taxes on low-cost internet-capable devices

- Use Universal Service & Access Funds to make devices more affordable for the poorest people

- Focus development aid on pilot innovations — like microfinancing and microloans — for device affordability and availability

Reduce taxes on low-cost devices

Policymakers can have a quick victory by reducing the taxes that apply to low-cost devices. Countries like Colombia and Kenya have already seen the benefits of such an approach. Targeted tax reductions can not only help make devices more affordable, but the short-term drop in tax revenue is frequently compensated by long-term gains in additional economic growth as user numbers grow. To be effective, governments must design and monitor policies carefully to make sure that changes in the tax regime actually translate into lower prices for consumers. Additionally, companies must commit to transfer fiscal policy related savings and cost reductions to consumers and consequently contribute to the expansion of digital opportunities.

Use Universal Service & Access Funds

Governments’ interest in supporting device affordability should not be limited to supply-side interventions. Universal Service & Access Funds can support greater access to ICTs, including smartphones, to underserved communities and marginalised groups. USAFs should change their strategies to include the promotion of wider smartphone adoption and availability.

The poorest households face the largest affordability barrier. USAFs exist to help these households access and use the internet. Countries like Malaysia, through its smart device subsidy, and Costa Rica, through the Hogares Conectados program, offer compelling examples of how USAFs can be used to make devices more affordable for the most vulnerable. A similar subsidy project in Ecuador shows the potential for governments to partner with network operators to help people connect. While this project was focused on mobile data, it could apply similarly to mobile devices.

Previous reports from A4AI have illustrated the underutilisation of Universal Service & Access Funds across the globe. Successfully managed, transparent, and active USAFs are part of the Affordability Drivers Index — a multivariable policy measurement tool correlated to greater internet affordability in low- and middle-income countries. These USAFs can and should be used to connect those who are least able to connect — and this should include making devices more affordable, a goal that should be supported by government, companies, and all stakeholders alike.

Support pilot projects for microfinance to scale

One important way to make devices more affordable for users is to develop innovative financing models to reduce the capital people need upfront to purchase a device. There is substantial opportunity in bringing together public and private sectors and civil society to support projects to make such financing available. Several examples already exist — many of them supported at a pilot-level by funders like development agencies. The next step is to move this from experiments to scale successful projects.

Most consumers fit into three groups:

- Those who can afford the upfront cost of a device.

- Those who cannot afford a device at all.

- middle group who cannot afford the upfront cost of a device but could afford to pay in installments.

Programs enabling the third group to pay monthly could help millions of people in countries that have limited systems of financial credit to buy devices. Microfinance and loan guarantees offer two promising means for development aid to support a broader market in this area.

Multilateral Developments Banks, like the World Bank and its regional peers, could have a huge impact in supporting countries’ inclusive digital growth but are currently directing too little funding towards ICTs. One of the most effective things they could do is to back public-private partnerships and offer funding to develop and scale innovative financing models. By providing financial guarantees to vendors to then help people spread the cost of devices, these institutions can help millions overcome the device price hurdle and increase the number of people with internet access.

— There are options to make devices affordable for billions. It’s now up to governments to find the willpower to do it. —

Countries looking to accelerate their digital economies must account for device prices and the barrier to access that they represent to billions of people across the globe. Without interventions, many will source their devices through secondhand, grey, and black markets with lower degrees of trust and sometimes poorer quality devices.

Tax policy and Universal Service & Access Funds offer two key levers to make devices more affordable. In addition, international cooperation — through development aid and multilateral development banks — can help to scale promising pilot financing projects to help more people buy an internet-connected device.

The cost of devices remains one of the biggest barriers to internet access. Policymakers can and must act now. More affordable devices will mean more people online and using the internet meaningfully. This will help countries more readily build inclusive, resilient, and scalable digital economies.

Annexes

Annex 1: Regional Summaries of Smartphone Prices

AFFORDABILITY TABLE (AFRICA)

| COUNTRY | PRICE (USD) | AFFORDABILITY |

|---|---|---|

| Botswana | $26.02 | 4.03% |

| Namibia | $34.18 | 7.81% |

| Mauritius | $83.05 | 8.27% |

| Gabon | $50.58 | 8.93% |

| Lesotho | $17.96 | 15.62% |

| South Africa | $84.04 | 17.63% |

| Morocco | $45.97 | 17.85% |

| Tunisia | $62.42 | 21.40% |

| Zambia | $27.63 | 23.19% |

| Algeria | $86.97 | 25.70% |

| Ghana | $49.17 | 27.70% |

| Cape Verde | $85.16 | 29.62% |

| Guinea | $20.70 | 29.92% |

| Tanzania | $29.09 | 34.23% |

| Cameroon | $41.98 | 34.98% |

| Mali | $25.29 | 36.56% |

| Liberia | $20.00 | 40.00% |

| Kenya | $58.10 | 43.04% |

| Mozambique | $18.76 | 51.15% |

| Egypt | $120.65 | 51.71% |

| Guinea-Bissau | $37.94 | 60.70% |

| Comoros | $67.44 | 61.31% |

| Uganda | $41.98 | 81.24% |

| Benin | $59.01 | 81.39% |

| Congo, DR | $33.74 | 82.63% |

| Madagascar | $31.77 | 86.65% |

| Burkina Faso | $53.11 | 96.56% |

| Côte d’Ivoire | $133.19 | 99.28% |

| Cent African Rep | $48.73 | 121.81% |

| Niger | $59.85 | 189.01% |

| Burundi | $51.68 | 221.48% |

| Sierra Leone | $265.20 | 636.48% |

AFFORDABILITY TABLE (AMERICAS)

| COUNTRY | PRICE (USD) | AFFORDABILITY |

|---|---|---|

| Jamaica | $20.40 | 4.91% |

| Mexico | $43.32 | 5.66% |

| Costa Rica | $58.45 | 6.09% |

| Colombia | $37.13 | 7.20% |

| Dominican Rep | $47.56 | 7.74% |

| Peru | $48.16 | 8.85% |

| Guyana | $39.85 | 10.05% |

| Brazil | $79.98 | 10.50% |

| Paraguay | $55.50 | 11.73% |

| Argentina | $121.93 | 11.83% |

| El Salvador | $41.99 | 13.19% |

| Belize | $67.91 | 17.27% |

| Bolivia | $56.96 | 20.28% |

| Suriname | $99.07 | 23.82% |

| Guatemala | $114.51 | 31.16% |

| Nicaragua | $57.49 | 33.98% |

| Haiti | $56.10 | 84.15% |

AFFORDABILITY TABLE (ASIA–PACIFIC)

| COUNTRY | PRICE (USD) | AFFORDABILITY |

|---|---|---|

| China | $55.37 | 7.02% |

| Thailand | $55.70 | 10.11% |

| Turkey | $94.39 | 10.91% |

| Sri Lanka | $37.47 | 11.07% |

| Fiji | $65.06 | 13.32% |

| Papua New Guinea | $28.15 | 13.35% |

| Kazakhstan | $89.96 | 13.79% |

| Solomon Islands | $35.41 | 21.25% |

| Viet Nam | $45.15 | 22.58% |

| Bangladesh | $33.54 | 23.00% |

| Georgia | $81.36 | 23.64% |

| Jordan | $112.83 | 32.16% |

| Philippines | $117.40 | 36.78% |

| Cambodia | $59.99 | 52.17% |

| Pakistan | $69.23 | 52.58% |

| Mongolia | $174.88 | 58.62% |

| Timor-Leste | $99.00 | 65.27% |

| Kyrgyzstan | $86.30 | 84.89% |

| Tajikistan | $88.17 | 104.76% |

| India | $346.13 | 205.62% |

Annex 2: Methodology

To support this research, the Alliance for Affordable Internet carried out a number of activities:

- A pricing exercise along a stated methodology based on the ITU’s ICT price basket methodology. This was limited to the 100 countries where our broadband data pricing covers: within that 100, a number of countries did not have valid offers that fit our methodology and were therefore excluded. This left us with 70 countries. Full data set available here.

- A series of focus group discussions, conducted by consultants, in Côte d’Ivoire, Ghana, Benin, Nigeria, and Cameroon. Four groups were organised in each country: three of consumers (urban users, rural users, and women) and one of device resellers. The consumers groups used this discussion guide, and the device resellers used this guide.

- A number of semi-structured, online interviews with various stakeholders.

Notably, much of this report and its research were affected by the Covid-19 pandemic. All of the pricing data was collected in March 2020, just as the World Health Organisation defined the situation as a pandemic and before many of its socio-economic consequences were felt around the world in their deepest severity. As this research progresses, we will continue to monitor to understand the full impacts of the pandemic on device affordability in the long-term.

The focus groups were conducted just as the relevant countries considered restrictions on social gatherings and freedom of movement. While the focus groups were able to proceed without any effect in Côte d’Ivoire, Benin, and Cameroon, some of the focus groups in Nigeria (one group) and Ghana (two) were conducted online rather than in person. While we structured our focus groups as to reimburse data costs for participants, to not make the affordability of data a barrier to participation, this inevitably presents a methodological limitation.