A4AI data benchmarks the cost of a new smartphone and feature phone in 187 countries.

The ever-changing circumstances of Covid-19 demonstrated how smartphones are an essential device for meaningful connectivity. They provided access to life-saving information, enabled students to continue their studies online, and fostered social connection. Despite this, smartphones remain unattainable for many around the world due to high costs.

What is the average cost of a new smartphone?

Across the 187 countries studied, we found that the global average cost of a smartphone is around 26% of an average monthly income, US$104. However, there are significant divisions in affordability between regions and countries that suggest smartphones remain inaccessible to many.

In some regions, people would have to spend far more than the global average. For example, in South Asia and Sub-Saharan Africa the number surpasses 40%. Even worse, in the Least Developed Countries, the average person would have to spend over half of their monthly income to buy a smartphone. Those in low-income countries have to spend almost 70% of their average monthly income to purchase the cheapest available smartphone on the market.

Figure 1 – Smartphone Affordability by Region | Source: Alliance for Affordable Internet (Made with Highcharts)

In sharp contrast, in regions such as Latin America & the Caribbean that have higher average incomes, the cheapest smartphone on the market represents only 14% of their monthly income. In North America, that number drops even further to just a mere 2%.

Massive disparities persist between high- and low-income countries with respect to connectivity. It also demonstrates that, as smartphones become increasingly important income-generating tools, the areas where they may be most needed will also be the areas where they’ll be most scarce.

Is this the cost of the same device in each country?

Not all devices are created equal. Some countries have more devices than others, and the reference device varies by country: we recorded the cheapest smartphone and feature phone in each country, offered by leading operators in each country.

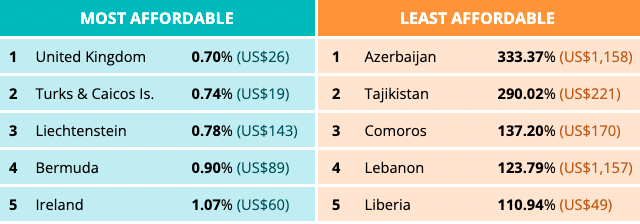

Overall, we find shocking disparities in mobile affordability between countries — and cases with the least affordability are not necessarily in countries with lower average incomes. Instead, in many cases, markets that only offer consumers a limited selection of high-end brands and devices affect the position of these countries in the data.

For example, the most affordable phone offered in Azerbaijan is the iPhone 12 mini — which costs more than three times the country’s average monthly salary. In contrast, the most affordable economies such as the United Kingdom, Ireland, and Turks & Caicos, all offer Alcatel phones as their cheapest, a brand notable for its lower prices.

This reality shows one of the ways operators can play a role in advancing affordability, by diversifying their inventory to offer a variety of brands and enabling greater consumer choice as they leverage their role as a trusted source within the digital ecosystem for many users, especially those in low- and middle-income countries connecting for the first time.

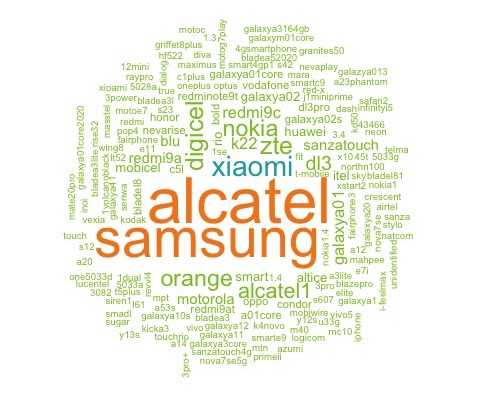

Which brands offer the cheapest smartphones, globally?

Despite the differences in product offerings across markets, certain brands of smartphones recur as the most affordable device across different countries. For millions of people around the world, these devices are gateways to internet access. Alcatel and Samsung were the leading brands in our dataset, with Alcatel present in 18% of the markets as the cheapest brand available, and Samsung offering the most affordable smartphone in 28 of the 187 economies that we studied. By brand, the cost of an Alcatel is 17% of average monthly income, while for Samsung the affordability goes up to 42% relative to incomes in the markets where it was the cheapest device.

Beyond commercial brands, a common practice in several markets are devices sold under the name of the mobile network operators, produced by an original design manufacturer and commonly known as ODMs. In 19% of countries, these types of devices – which are offered by network operators such as Orange, Digicel, and Vodafone – are the most affordable. On average, these devices cost under US$30 each. Both the Alcatel and ODM smartphones are key to onboarding new users at an affordable price and close the digital divide.

What are feature phones, and why do they matter?

While smartphone ownership continues to increase, over 140 of the operators we analyzed also offered feature phones, which are internet-capable mobile devices that resemble earlier mobile models with tactile keyboards or keypads and only support basic applications. When high device costs keep millions offline, feature phones are often affordable alternatives to smartphones to connect to the internet, especially for first-time users.

Alcatel, Nokia, and Crosscall are a few of the most common brands offering feature phones, as well as many ODMs. More than 30% of these phones use KaiOS, an operating system designed to bring internet-based functionality to mobile devices with a keyboard input.

How did we collect this data?

In July of 2021, we collected pricing data for the cheapest smartphones offered by mobile networks operators with no less than 15% of a country’s mobile-broadband capable connections to evaluate how affordable smartphones and feature phones are globally. We measure device affordability by using the device price as the portion of average monthly income in a given country. More details are available in our methodology note.

Following our publication of From Luxury to Lifeline in 2020, this is A4AI’s second data collection on device pricing to measure progress on affordability and encourages policymakers to implement changes that would ensure universal access and connectivity.